Services

Services Charges

| Cheque book charge | Rs 1.00 /Leaf+ Gst |

| Cheque Return Charge | Rs 100.00 +Gst |

| ATM Charges | Rs 100.00 + Gst Yearly |

| Minimum Balance Charge Saving Account | Rs 50.00+ Gst Monthly |

| Minimum Balance Charge Current Account | Rs 100.00+ Gst Monthly |

| NEFT charges | Up to Rs. 10000 – charges Rs. 2/- plus Gst |

| From 10001 to Rs. 100000 – charges Rs. 5/- plus Gst | |

| From 100001 to Rs. 200000 – charges Rs. 15/- plus Gst | |

| Above Rs. 200000 – charges Rs. 25/- plus Gst | |

| RTGS Charges | Rs. 200000 to Rs. 500000 – charges Rs. 30/- plus Gst |

| Above Rs. 5 Lakh – charges Rs. 55/- plus Gst |

| Services:- | Branch Working:- | |

| NEFT / RTGS Facility | Main Branch – 7 Days | |

| SMS Alert | ||

| ATM Facility | ||

| POS Terminal | ||

| IMPS Facility/ CTS Clearing |

Detail About ATM Card Parental Control

CARD SAFE, which can be downloaded from play store. where it gives various feature which include pin change and other from any where through your smart phone.

Step 1: After app installation enter your contact no which is linked with ATM transaction.

Step 2: Enter received OTP and proceed further make a four-digit which will be your MPIN later to access the app.

Step 3: Proceed with the for digit MPIN made by you in step 2. Here your parental control over ATM is ready to use.

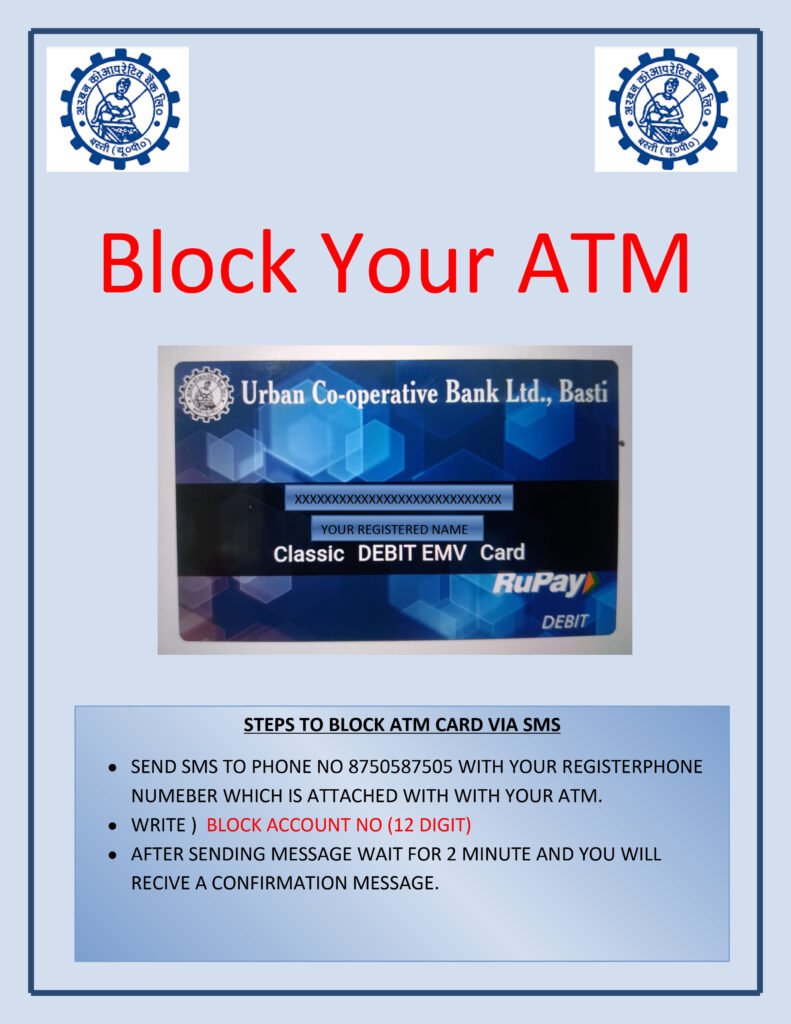

In case to block your ATM simply message to 8750587505 BLOCK XXXXXXXXXXXX

Here XXXXXXXXXXXX is your account no and send message it from that particular contact number which is attached to ATM. In that particular case only, it will respond.

ATM block process takes 30 sec to respond and in total 1 minute to block it all.

Step 1: After app installation enter your contact no which is linked with ATM transaction.

Step 2: Enter received OTP and proceed further make a four-digit which will be your MPIN later to access the app.

Step 3: Proceed with the for digit MPIN made by you in step 2. Here your parental control over ATM is ready to use.

In case to block your ATM simply message to 8750587505 BLOCK XXXXXXXXXXXX

Here XXXXXXXXXXXX is your account no and send message it from that particular contact number which is attached to ATM. In that particular case only, it will respond.

ATM block process takes 30 sec to respond and in total 1 minute to block it all.

Kit Contain

PASSBOOK

Mandatory part of banking as it consists various information of customer also an identity of being a privilege customer.

CHEQUEBOOK

It contains 30 cheques with indexing and various other information regarding customer account, which is required by bank to clear the cheque at it very first appeal. It’s a CTS cheque which can be accepetd by any bank as per under RBI guideline.

DEBIT CARD Through Debit Card its owner can use it on ATM, POS and E-Com. well from ATM one can withdraw maximum 20,000 in a day and five transaction too. Whereas POS and E-Com limit can be upto 75,000 in a day. Our card can be used PAN India anywhere with any terminal.

Mandatory part of banking as it consists various information of customer also an identity of being a privilege customer.

CHEQUEBOOK

It contains 30 cheques with indexing and various other information regarding customer account, which is required by bank to clear the cheque at it very first appeal. It’s a CTS cheque which can be accepetd by any bank as per under RBI guideline.

DEBIT CARD Through Debit Card its owner can use it on ATM, POS and E-Com. well from ATM one can withdraw maximum 20,000 in a day and five transaction too. Whereas POS and E-Com limit can be upto 75,000 in a day. Our card can be used PAN India anywhere with any terminal.